Kelley Blue Book Bring Your Car Search Into Focus

Commentary & Voices

Q4 2021 Kelley Blue Book Brand Watch Non-Luxury Report: New Products Lift Ford to Most-Shopped Brand, Beating Toyota

Friday February 4, 2022

Article Highlights

- F-150, Mustang Mach-E, Maverick and Explorer drive shopping for Ford higher.

- Consumer interest in hybrids and EVs is moving mainstream.

- Truck consideration returns to its peak on improved availability and economic forces.

Hot new products and more plentiful inventory pushed the Ford brand to No. 1 in shopping consideration in the fourth quarter of 2021, a spot Toyota had held for nearly four years straight, according to the Kelley Blue Book Brand Watch Report for non-luxury vehicles.

The Kelley Blue Book Brand Watch Report™ is a consumer perception survey that also weaves in shopping behavior to determine how a brand or model stacks up with its segment competitors on a dozen factors key to a consumer's buying decision. Kelley Blue Book produces separate Brand Watch reports for non-luxury and luxury brands each quarter.

The fourth quarter of 2021 continued to be plagued by the global computer chip shortage that forced production cuts and vehicle inventory shortages, though it appeared the worst was over. However, Asian brands, particularly Toyota, Honda, Subaru and Kia, had the lowest inventories in the quarter, while the domestic brands, suffering during the summer, were beginning to rebuild supply. Supply likely influenced shopping behavior.

Ford Tops Toyota in Shopping

Shopping consideration for Ford was driven by strength for new and some old models and vehicles powered by new alternative powertrains as well as traditional gas engines.

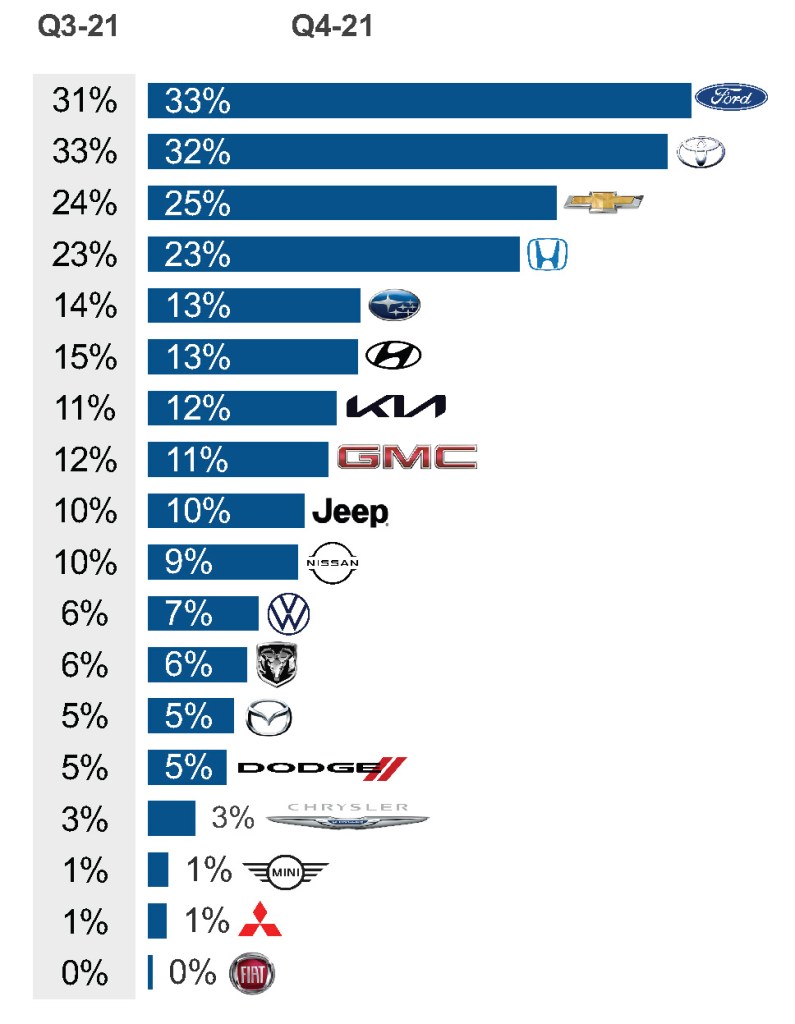

Of all shoppers of new, non-luxury vehicles, a full third considered a Ford, up 2 percentage points in the fourth quarter from the third quarter of 2021. That was the largest quarter-to-quarter increase for any non-luxury brand. That put Ford in first place, a spot it last held in 2015.

QUARTERLY BRAND CONSIDERATION

With its healthier supply than it had last spring, the Ford F-150, the most-shopped vehicle for eight consecutive quarters, saw a 12% gain in consideration in the fourth quarter from the third quarter. The hybrid version and the electric F-150 Lightning, which launches this spring and already is sold out, gave it a boost. So did the medium-duty F-250/350/450, which had a 3% gain in shopping.

Ford also benefited from the Maverick pickup, which comes standard as a hybrid or with an optional gas engine. The Maverick has become so popular that Ford has paused orders while it catches up on the backlog. The electric Mustang Mach-E and the stalwart Explorer also had higher shopping rates.

Heftier inventory may have aided Ford as well. Ford was hit hard by the chip shortage in early summer. In the fall, it was Toyota that got hammered by the chip crisis, forcing the automaker to slash production at plants across the globe and endure extreme product shortages, some of the lowest in the U.S. industry.

Despite the supply challenges, Toyota's shopping consideration slipped only a percentage point to 32% for second place. Toyota was last beaten in shopping in the fourth quarter of 2017 and the first quarter of 2018 by Honda. Still, Toyota won where it mattered last year – in sales. Toyota, with Lexus, beat General Motors for the first time in history. The Toyota brand outsold the Ford brand.

Shopping for the RAV4 dropped by 12%, but shopping for the RAV4 Hybrid, despite its extremely low supply, had an 18% gain in shopping. The Toyota Tacoma, with its tight inventories, also slipped in shopping consideration.

The Rest of the Pack

Chevrolet ranked No. 3 in shopping consideration, gaining a percentage point on the strength of the Chevrolet Silverado 1500 pickup truck and Malibu sedan. A full quarter of all non-luxury shoppers considered the brand. Other gainers were Kia and Volkswagen, both up a percentage point.

Hyundai, which had been the big winner in the third quarter of 2021, fell back, having the largest drop in shopping consideration, down 2 percentage points. Subaru dipped a percentage point with double-digit falloffs in shopping for its volume-leading Forester and Outback, which have very low inventory. GMC and Nissan each slipped a percentage point.

The rest of the pack held steady from the previous quarter. Honda maintained its No. 4 spot with 23% of all shoppers considering the brand despite a dip in shopping for its volume-leading CR-V. Jeep stayed at 10% even though the new Jeep Grand Cherokee saw a 15% increase in shopping activity. Jeep added two other new models last year, the Wagoneer and Grand Wagoneer.

Truck Consideration Climbs

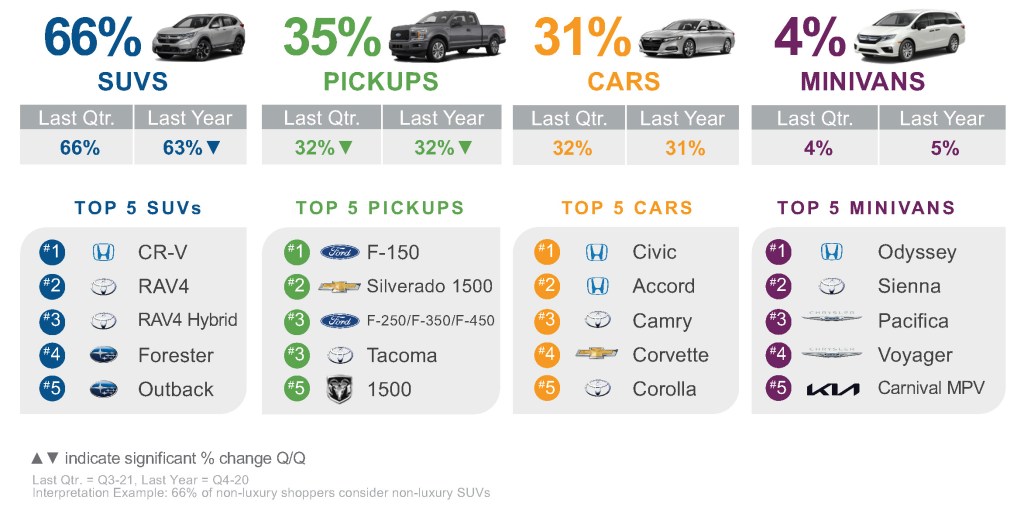

Shopping consideration for pickup trucks is back up. Wider availability as the domestic brands, strong in trucks, built up supply after shortages over the summer. A robust construction industry, accelerated by the federal government's passage of the infrastructure bill, along with a brisk market for housing starts and home improvement businesses pushed up truck consideration. So did interest in new powertrain options, like hybrids and electric trucks.

Of all non-luxury vehicle shoppers, 35% considered a pickup truck, that's up from 32% in the year-earlier fourth quarter as well as last year's third quarter. The list of Top 5 most-shopped pickup trucks were, in order: Ford F-150; Chevrolet Silverado 1500; Ford F-250/F-350/F-450; Toyota Tacoma; and Ram 1500. The list was the same as the previous quarter with Ford's big trucks swapping spots with the Toyota Tacoma.

QUARTERLY SEGMENT CONSIDERATION

SUVS Reign Supreme

As long has been the case, SUVs reigned supreme with 66% of all non-luxury shoppers considering an SUV, the same level as the third quarter but up from a year ago. Every model on the Top 5 list of most-shopped SUVs is from a Japanese brand, specifically Toyota, Honda and Subaru.

Despite dips in consideration for all, the Honda CR-V and Toyota RAV4 remained No. 1 and No. 2, respectively, for most-shopped SUVs in the fourth quarter. The Subaru Forester and Outback, both of which had double-digit declines in shopping likely due to scant inventory, were No. 4 and No. 5, respectively.

A newcomer to the Top 5 SUV list was the Toyota RAV4 hybrid, which saw a large gain in shopping and has been the most-shopped electrified vehicle for several quarters. Breaking into the Top 5 list suggests electrified vehicles are becoming increasingly mainstream. The RAV4 hybrid knocked the Kia Telluride off the Top 5 list from the last quarter. In the year-ago quarter, the Ford Explorer and Toyota Highlander were on that list.

Shopping for traditional cars slipped to 31% of all non-luxury shoppers, roughly the same as it has been. The Top 5 most-shopped car list contained the usual suspects from Japanese brands – Honda Civic and Accord, Toyota Camry and Corolla. Sandwiched in between, however, was the Chevrolet Corvette, which celebrates its 70th anniversary this year with a new, high-performance version.

Minivans held at only 4% of all non-luxury shoppers considering such a people mover. The Top 5 most-shopped models on the shortlist of minivans available were, in order, the Honda Odyssey, Toyota Sienna – available only as a hybrid now – the Chrysler Pacifica – available as a plug-in hybrid – the fleet-favorite Chrysler Voyager and the Kia Carnival.

The Top 10 Most-Shopped List

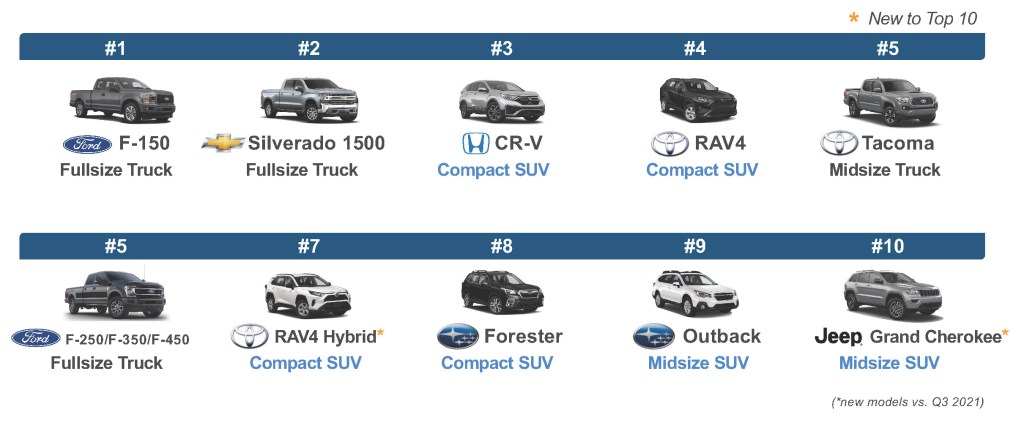

Looking at the list of Top 10 most considered non-luxury vehicles, six were SUVs and four were pickup trucks. No cars made the list.

Top 10 Models Considered

The Ford F-150 remained the most-shopped non-luxury vehicle for the eighth consecutive quarter. The Chevrolet Silverado moved up to the No. 2 spot. The Honda CR-V slipped past the Toyota RAV4 for the No. 3 spot. Toyota Tacoma moved up to No. 5, tying with Ford's larger pickups.

Redesigned last year and available in a long and shorter version, the Jeep Grand Cherokee was a newcomer to the list, coming in at No. 10. The Toyota RAV4 hybrid was a first-timer. The rest of the list was rounded out by the Subaru Forester and Outback.

Factors Important to Consumers

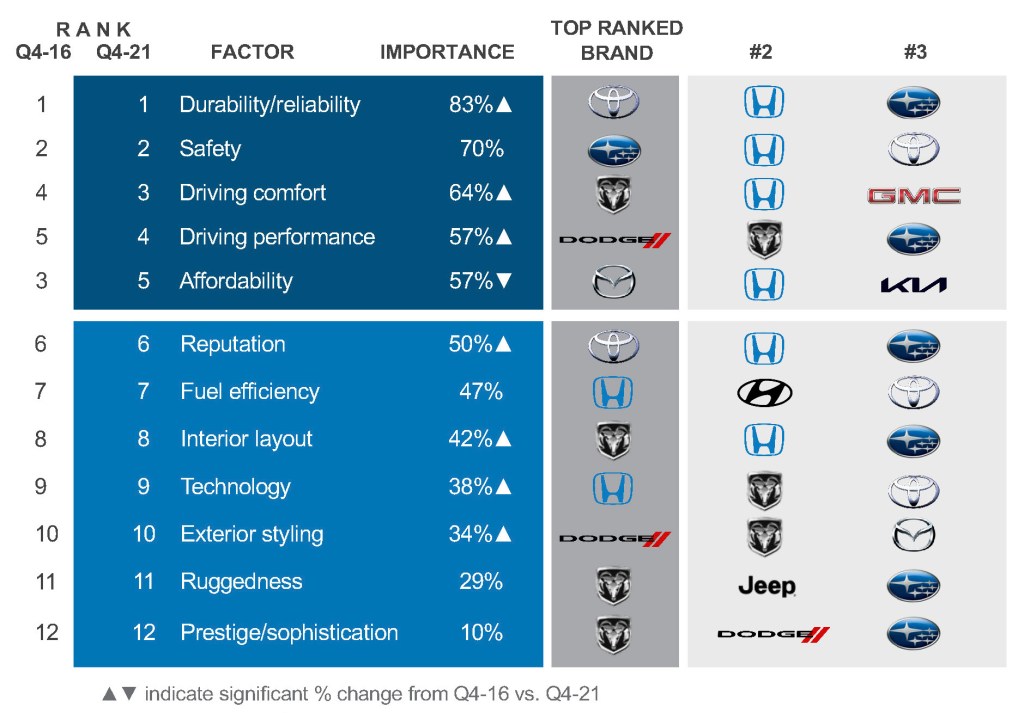

Stellantis brands Ram and Dodge had a good showing in the dozen factors most important buyers.

The Ram's bold styling and towing capability boosted it to top honors for Driving Comfort, Interior Layout, Ruggedness and Prestige/Sophistication. It nabbed the No. 2 spots in three factors – Driving Performance, Technology and Exterior styling.

Dodge's Brotherhood of Muscle campaign focused on performance and handling, which clearly resonated with shoppers. It helped Dodge reach No. 1 for Driving Performance and edge out Ram for No. 1 in Exterior Styling. It marked the first time Dodge took the styling honors. Dodge also was a winner in sales last year, beating other muscle cars.

Honda has been a roller-coaster in the factors portion of the Kelley Blue Book Brand Watch. In the third quarter, after a three-year slump, it regained some momentum. But that was short-lived as it lost some steam in the fourth quarter. It still held on as the leading brand for Fuel Efficiency and Technology, and it nabbed a half-dozen second-place spots in other categories.

Subaru stayed tops in Safety, which is the second most important factor for buyers, but did not occupy any No. 2 spots, grabbing a half-dozen third-place positions.

Despite new-vehicle prices soaring in the past year due to inventory shortages caused by the chip crisis, the importance of affordability has dropped. That may suggest that new car prices have risen to the point that some shoppers can't even consider a new car and, instead, turn to used. The smaller pool of buyers who can purchase a new car is more affluent, so affordability is less of an issue and, based on Cox Automotive surveys, expect to pay a premium. Similarly, gas prices rose during the quarter, yet the importance of fuel efficiency did not budge.

What has gained in importance to buyers over the years is Durability/Reliability, always No. 1 by a widening margin, Driving Comfort, Driving Performance, Reputation, Interior Layout, Technology and Exterior Styling.

FACTORS DRIVING NON-LUXURY CONSIDERATION

Michelle Krebs is executive analyst at Cox Automotive.

Tags

robinsonhispeciam1973.blogspot.com

Source: https://www.coxautoinc.com/market-insights/q4-2021-kelley-blue-book-brand-watch-non-luxury-report/

0 Response to "Kelley Blue Book Bring Your Car Search Into Focus"

Post a Comment